Discover Credit Card Login, Payment, Customer Service

Discover Credit Card

In the vast landscape of credit cards, Discover stands out as a prominent player that has revolutionized the credit card industry. With a rich history spanning over three decades, Discover has consistently offered innovative features, exceptional customer service, and an array of rewards programs that cater to the diverse needs of its cardholders. This article delves into the features, benefits, and advantages that make Discover Credit Card a popular choice among consumers seeking financial flexibility and rewards.

Why Choose Discover Credit Card?

Discover Credit Card offers several benefits that make it a popular choice for many individuals. Here are some reasons why people choose Discover Credit Card:

- Cashback rewards: Discover Credit Card is known for its generous cashback rewards program. Cardholders can earn cashback on their purchases, usually ranging from 1% to 5% depending on the category. Discover also offers rotating quarterly categories where you can earn higher cashback rates on specific types of purchases.

- No annual fee: Many Discover Credit Card options have no annual fee, which means you won’t have to pay a yearly fee just for having the card. This can be particularly beneficial if you want to save money and avoid unnecessary expenses.

- Customer service: Discover is often praised for its excellent customer service. The company has won awards for its customer satisfaction and is known for its responsive and helpful customer support team.

- Wide acceptance: Discover Credit Cards are widely accepted both domestically and internationally. While Discover might have had more limited acceptance in the past, it has significantly expanded its network and is now accepted at millions of merchants across the globe.

- Introductory offers: Discover often provides attractive introductory offers for new cardholders, such as 0% APR (Annual Percentage Rate) on purchases or balance transfers for a certain period. These offers can help you save money on interest charges or consolidate debt.

- Security features: Discover offers robust security features to protect its cardholders against fraud and unauthorized charges. They monitor your account for suspicious activity and provide options to freeze your card or set up alerts for added security.

- Additional benefits: Discover Credit Card comes with additional perks, such as free access to your FICO credit score, zero liability protection for unauthorized purchases, and extended warranty coverage on eligible purchases.

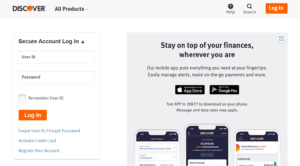

Discover Credit Card Login

To log in to your Discover credit card account, you can follow these steps:

- Open a web browser and go to the Discover Card website (www.discover.com)

- On the homepage, you will find a “Log In” button in the top right corner. Click on it.Alternatively, you can directly access the login page by visiting the following URL: https://portal.discover.com/customersvcs/universalLogin/ac_main.

- You will be taken to the Discover Card login page.

- Enter your User ID in the provided field. If you haven’t registered yet, click on the “Register Your Account” link to create a new account.

- After entering your User ID, click on the “Continue” button.

- On the next page, you will be prompted to enter your password. Enter your password in the provided field.

- Click on the “Log In” button to access your Discover credit card account.

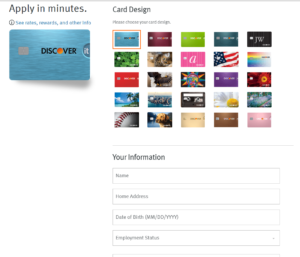

How to Apply for Discover Credit Card?

To apply for a Discover Credit Card, you can follow these general steps:

- Go to the official Discover Card website (www.discover.com/credit-cards/) using a web browser on your computer or mobile device.

- Browse through the different credit card options offered by Discover. They may have cards with different features, rewards programs, and benefits. Consider your needs and preferences to choose the card that suits you best.

- Once you have selected the credit card you want, click on the corresponding button to start the application process. This will usually be labeled as “Apply Now” or “Get Started.”

- Fill out the application form with your personal details, including your full name, address, contact information, date of birth, Social Security number, and employment information. Make sure to provide accurate information.

- You will also need to provide information about your income, employment status, and monthly housing payment. This helps the credit card issuer assess your creditworthiness.

- Some credit cards may offer additional features or customization options. Review these choices and select the ones that best suit your preferences.

- Carefully read through the terms and conditions associated with the credit card you are applying for. Pay attention to the interest rates, fees, rewards program details, and any other relevant information.

- Once you have completed all the necessary sections and reviewed the information, submit your application. Depending on the issuer, you may receive an immediate decision or have to wait for a response.

- The credit card issuer will review your application and determine whether to approve or decline it. They may conduct a credit check as part of their evaluation process. If approved, you will receive your card in the mail within a few weeks.

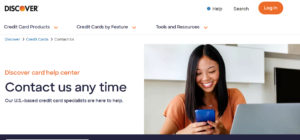

Discover Credit Card Customer Service

To contact Discover Credit Card’s customer service, you can try the following methods:

- Phone: Call the Discover customer service phone number:

1-800-347-2683

This line is available 24/7, and you can speak directly with a representative to address your concerns.

- Online Chat: Visit the Discover website (www.discover.com) and navigate to the customer service section. Look for the “Chat” option, if available. This allows you to communicate with a customer service representative via instant messaging.

- Secure Message: Log in to your Discover online account and send a secure message through the online messaging system. This method allows you to document your queries or issues and receive a response from the customer service team.

- Social Media: Reach out to Discover’s customer service team through their social media channels, such as Twitter (@Discover) or Facebook (@Discover). Send them a direct message or publicly post your query, and they should respond accordingly.

- In-Person: If you prefer face-to-face interactions, you can visit a Discover branch location and speak with a customer service representative in person. Use the branch locator on their website to find the nearest branch.

Also Read: Gap Credit Card Login, Payment, Customer Service

Discover Credit Card FAQs

Is Discover a good credit card?

Discover is generally considered to be a reputable and reliable credit card issuer. They offer a variety of credit cards with different features, rewards programs, and benefits, so it's important to evaluate whether a specific Discover credit card aligns with your needs and preferences. Discover is known for their strong customer service and competitive cashback rewards programs. However, it's always a good idea to compare different credit card options and read reviews to determine which one suits your individual financial situation and spending habits the best.

Is Discover credit card good?

Discover credit cards are well-regarded by many consumers. They often offer competitive rewards programs, such as cashback on purchases, and provide additional benefits like no annual fees, 0% introductory APR periods, and free access to your FICO credit score. Discover is widely accepted in the United States, so you can use their cards at many retailers and online merchants. Ultimately, whether a Discover credit card is "good" for you depends on your personal financial goals and spending patterns. It's recommended to review the terms and conditions, benefits, and rewards of a specific card to determine if it aligns with your needs.

How to close a Discover credit card?

If you have decided to close your Discover credit card account, you can follow these general steps:

a. Pay off any outstanding balance: Ensure that you have paid off any remaining balance on your card. You can do this by making a payment online, over the phone, or through the Discover mobile app.

b. Redeem any rewards: If you have accumulated any rewards or cashback on your Discover card, consider redeeming them before closing the account. Once the account is closed, you may lose the ability to access those rewards.

c. Contact Discover: Reach out to Discover's customer service either by phone or through their secure messaging system. Inform them of your intention to close the account and request the necessary steps to do so.

d. Follow the instructions: Discover will guide you through the account closure process. They may ask you to provide specific information, such as your account number, personal details, and reasons for closing the account.

e. Confirm closure: Once you have completed the necessary steps, confirm with Discover that your credit card account has been successfully closed. You may want to follow up with a written request for closure for your records.

How to apply for a Discover credit card?

To apply for a Discover credit card, you can follow these general steps:

a. Visit Discover's website: Go to Discover's official website and navigate to the "Credit Cards" section.

b. Explore available cards: Review the different credit card options offered by Discover. Consider factors such as rewards programs, interest rates, annual fees, and benefits to choose the card that suits your needs.

c. Click "Apply Now": Once you have chosen a specific card, click on the "Apply Now" button associated with that card.

d. Provide necessary information: Fill out the application form, which will require personal information such as your name, address, social security number, employment details, and financial information. Make sure to provide accurate information.

e. Review and submit: Double-check all the information you have entered and review the terms and conditions of the card. If you are satisfied, submit your application.

f. Await a decision: Discover will review your application and determine your eligibility. The process typically involves a credit check. You may receive an instant decision or need to wait a few days to receive a response.

What credit score do you need for a Discover card?

The specific credit score required to be approved for a Discover card can vary depending on the card you are applying for and other factors considered during the application process. Discover offers a range of credit cards, some of which are designed for individuals with excellent credit scores, while others are available to individuals with fair or average credit.

Gap Credit Card Login, Payment, Customer Service

Discover Credit Card In the vast landscape of credit cards, Discover stands out as a prominent player that has revolutionized the credit card industry. With a rich history spanning over three decades, Discover has consistently offered innovative features, exceptional customer service, and an array of rewards programs that cater to the diverse needs of its …

Best Buy Credit Card Login, Payment, Customer Service

Discover Credit Card In the vast landscape of credit cards, Discover stands out as a prominent player that has revolutionized the credit card industry. With a rich history spanning over three decades, Discover has consistently offered innovative features, exceptional customer service, and an array of rewards programs that cater to the diverse needs of its …

UdKBzQsTEF